Tax effective fringe benefits in Hungary from 2024

In our newsletter, we will give you an overview of the current fringe benefit elements and their tax rates applicable in the year 2024 following the changed rules adopted last days of November 2023.

Dear Clients, Dear Readers,

In our newsletter, we will give you an overview of the current fringe benefit elements and their tax rates applicable in the year 2024 following the changed rules adopted last days of November 2023.

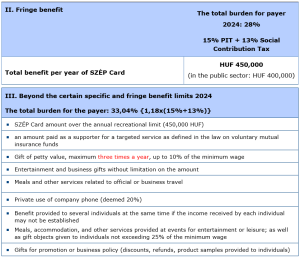

The tax rate to be paid by the payment agent will not change next year. Some thresholds will be raised due to the increase in the minimum wage to HUF 266,800, tax-free benefits will be extended to wine products and small gifts will again be allowed three times a year.

What is new is that from 2024, the tax declaration and payment for fringe benefits and certain defined benefits will no longer be monthly but quarterly.

If you are also thinking about the application of fringe benefits or SZÉP Card and you want to provide it with less administration but give more flexible options to the employees, we would like to call your attention to our cafeteria software.

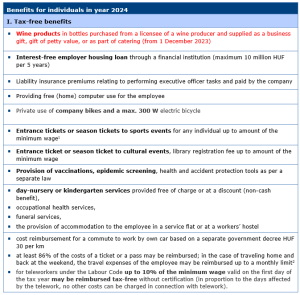

Please find the list of fringe benefits for the year 2024:

[1] the minimum wage is HUF 266’800 in year 2024

[2] maximum amount in 2023 is HUF 47’820/month

We hope that the overview above can support you in your decisions regarding cafeteria benefits in 2024. Our colleagues will be pleased to help you in interpreting the rules detailed above.

Kind regards,

ABT Treuhand Group

The above summary is provided for information purposes only. We recommend that you consult our experts before making any decision based on this information. For more information about our services, please visit our website: www.abt.hu

Date: 11. December 2023 | Topic: Business TaxationBusiness Taxation

The above summary is provided for information purposes only. We recommend that you consult our experts before making any decision based on this information.

Nexia International is a network combining the expertise and experience of nearly 320 independent tax consulting and audit firms from over 100 countries worldwide and is ranked as the 10th largest such network in the world.